How Much Is The Skiff (La Yole) Worth?

Last updated: January 20, 2026

Quick Facts

- Methodology

- comparable analysis

Hypothetical fair-market value for Pierre-Auguste Renoir’s The Skiff (La Yole), 1875, is $55–90 million. This museum-caliber, prime-period Impressionist masterwork ranks among the artist’s most desirable themes and dates, warranting a tier just below Renoir’s category ceiling, subject to trophy-level demand.

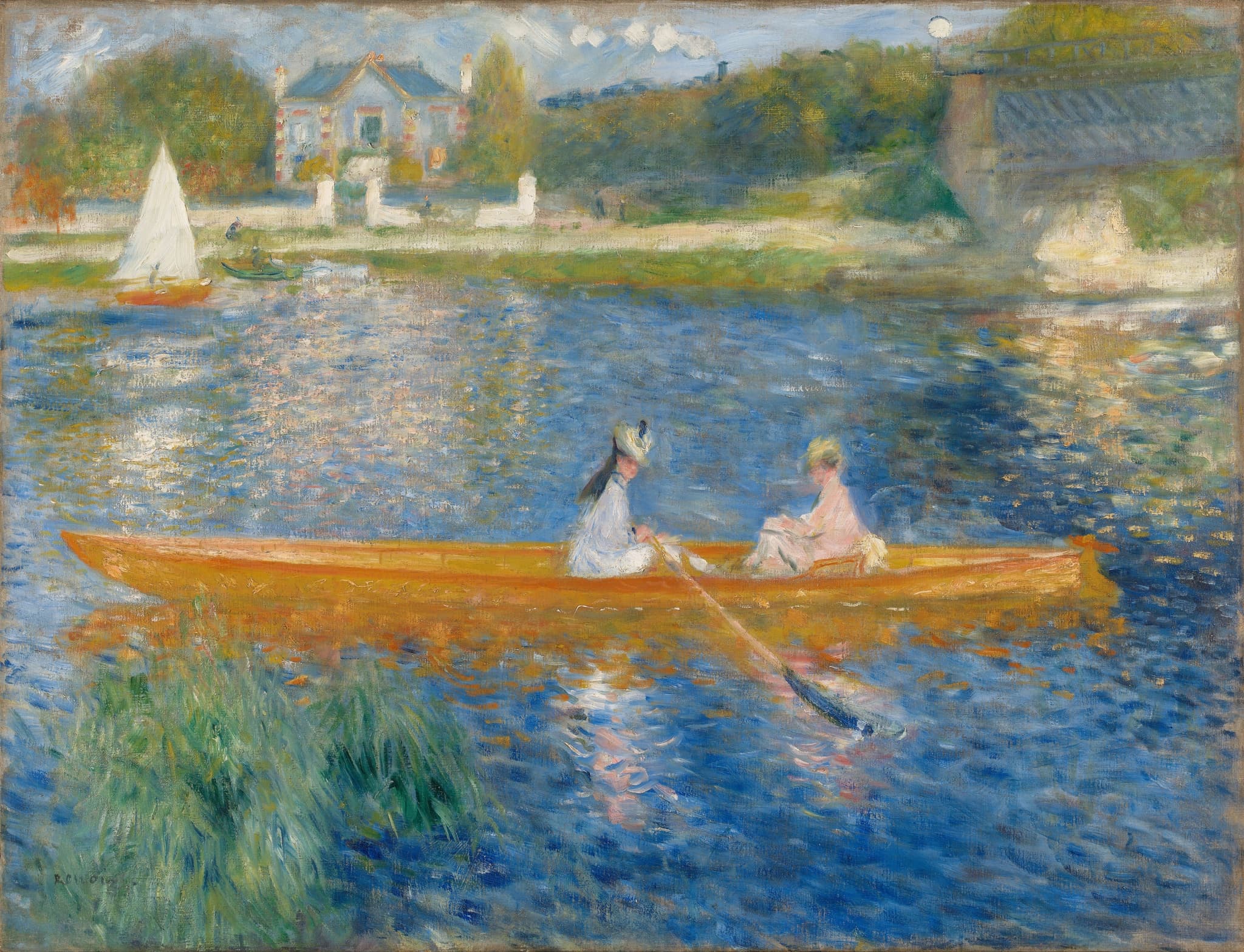

The Skiff (La Yole)

Pierre-Auguste Renoir, 1875 • Oil on canvas

Read full analysis of The Skiff (La Yole) →Valuation Analysis

Conclusion: If hypothetically offered today, Pierre-Auguste Renoir’s The Skiff (La Yole) (1875, oil on canvas, 71 × 92 cm; National Gallery, London) would reasonably be valued at $55–90 million. The work encapsulates Renoir’s prime Impressionist manner—brilliant light effects, broken color, and a quintessential leisure-on-the-Seine subject—placing it among the most coveted segments of his oeuvre [1].

Benchmarking the ceiling: Renoir’s auction record remains the 1990 sale of Bal du moulin de la Galette at $78.1 million, a landmark that still frames the upper bound of public market pricing for the artist [2]. While The Skiff is not as globally iconic as Moulin de la Galette, it is nonetheless a signature, widely reproduced composition from the mid-1870s that would attract deep international demand. Our range positions it below Renoir’s absolute pinnacle while acknowledging trophy-level scarcity and appeal.

Recent market evidence: High-quality Renoir oils continue to perform, but recent eight-figure results tend to concentrate in best-known subjects and top-quality examples. For example, a Baigneuse realized $10.41 million at Christie’s in 2025, while a prime-date (1870s) still life, Bouquet de lilas, achieved £6.88 million in London in 2024—both strong but clearly less market-defining than a major 1875 Seine leisure scene [3][4]. These comparables underscore the step-change in value for canonical, mid-1870s subjects like The Skiff.

Provenance and institutional stature: The painting’s distinguished ownership history—Victor Chocquet, Galerie Bernheim-Jeune, Samuel Courtauld—and its acquisition by the National Gallery (1982, private treaty) materially enhance confidence and desirability [1]. Works from this circle, date, and visibility rarely appear on the market; that scarcity underpins the estimate’s upper half.

Market positioning: Within Impressionism, Monet commands the highest sustained demand, but Renoir remains a blue-chip stalwart with deep, global collector bases. Category performance in 2024–2025 shows selective strength for museum-caliber works, with disciplined bidding but robust outcomes for rare, emblematic pictures; Sotheby’s 2024 London results affirmed resilient demand for high-quality Impressionist material [3]. On balance, and assuming sound condition commensurate with National Gallery standards, a $55–90 million fair-market range is justified by prime date, iconic subject, exhibition-scale format, prestigious provenance, and the artist’s historic price benchmarks.

Key Valuation Factors

Art Historical Significance

High ImpactPainted in 1875, The Skiff (La Yole) epitomizes Renoir’s prime Impressionist practice—luminous color, vibrant brushwork, and a quintessential modern-leisure motif on the Seine. It is a frequently illustrated, widely recognized composition that appears in core discussions of the artist’s 1870s period, when he produced many of his most celebrated masterpieces. While not as universally renowned as Bal du moulin de la Galette, it sits near the top tier of Renoir’s oeuvre in subject and date, bridging key themes (light, water, contemporaneity) that collectors prize. The painting’s art-historical weight ensures global cross-category appeal and a robust competitive auction dynamic, particularly among museums and top private collectors focused on Impressionist benchmarks.

Period and Subject Desirability

High ImpactMid-1870s Renoir is the market’s sweet spot, and boating/leisure scenes on the Seine are among his most sought-after subjects. This picture offers the immediacy and modernity collectors associate with Impressionism’s breakthrough decade: open-air color, dynamic handling, and a compelling depiction of middle-class leisure. The river setting connects it to the era’s defining narratives and to famous peers (e.g., Monet’s Argenteuil cycle), situating it in a coveted cross-current of subject, date, and style. The enduring popularity of Renoir’s leisure imagery bolsters demand beyond traditional Impressionist buyers, supporting a valuation premium over equally fine but less iconic subjects like later domestic scenes, garden portraits, or still lifes.

Provenance and Institutional Visibility

High ImpactThe Skiff’s provenance—Victor Chocquet (a key early champion), Bernheim-Jeune (preeminent dealer), Samuel Courtauld (transformative British collector), and ultimately the National Gallery—confers exceptional credibility and prestige. Works that have passed through this caliber of stewardship carry reduced transactional risk and amplified desirability. Its long-term institutional housing, documentation, and exhibition history provide scholarly validation and public recognition that typically translate into stronger auction performance. While the painting is not for sale, this provenance profile would be a powerful accelerant in any hypothetical deaccession or private sale scenario, increasing the likelihood of multiple third-party guarantees and top-tier competitive bidding.

Market Comparables and Liquidity

Medium ImpactRecent Renoir sales show steady performance for quality works, with eight-figure outcomes reserved for superior subjects and freshness. A Baigneuse brought $10.41 million in 2025 and a prime-date still life achieved £6.88 million in 2024—healthy but a different echelon from a canonical 1875 Seine-leisure scene. Renoir’s all-time auction peak of $78.1 million (1990) sets a durable benchmark, with present-day taste placing Monet above Renoir, tempering probabilities of a nine-figure Renoir absent a universally iconic masterpiece. Given scarcity of comparable mid-1870s leisure pictures in private hands, liquidity for The Skiff would be strong, justifying a $55–90 million band under current top-end Impressionist demand.

Sale History

Galerie Bernheim-Jeune, Paris (estate of Victor Chocquet)

Acquired by Bernheim-Jeune from the estate of Victor Chocquet; year recorded, exact date and price not published.

Galerie Bernheim-Jeune, Paris (private sale to Samuel Courtauld)

Private acquisition by Samuel Courtauld; year recorded, exact date and price not published.

Private treaty via Thomas Gibson Fine Art Ltd to the National Gallery, London

Acquired by the National Gallery in 1982 via private treaty; price confidential.

Pierre-Auguste Renoir's Market

Pierre-Auguste Renoir is a core, blue-chip Impressionist with a broad and enduring global collector base. His all-time auction record is $78.1 million for Bal du moulin de la Galette (Sotheby’s, 1990), a bellwether that continues to anchor pricing at the top of his market. In recent seasons, desirable Renoir oils have typically transacted from the low seven figures up to the low eight figures, with exceptional works achieving more. While contemporary demand places Monet above Renoir in price and velocity, trophy-level Renoirs remain scarce and highly contested, especially when they feature prime 1870s dates, luminous color, and canonical subjects such as leisure on the Seine or iconic bathers.

Comparable Sales

Bal du moulin de la Galette (Dance at Le Moulin de la Galette)

Pierre-Auguste Renoir

Top-tier, iconic Renoir from the prime Impressionist years (1876). While not a boating scene, it is a leisure masterpiece from essentially the same period and scale of ambition, serving as the benchmark ceiling for Renoir at auction.

$78.1M

1990, Sotheby's New York

~$187.0M adjusted

Baigneuse (Bather)

Pierre-Auguste Renoir

Eight-figure Renoir oil sold recently; strong subject (bather) but later date (1891) and not a large, public-leisure Seine scene. Useful for current demand and pricing of quality Renoir oils.

$10.4M

2025, Christie's New York

Bouquet de lilas

Pierre-Auguste Renoir

Prime 1870s date proximate to The Skiff (1878 vs. 1875), demonstrating appetite for high-quality Renoir oils from the key decade, albeit a still life (less iconic subject than boating/leisure on the Seine).

$8.7M

2024, Sotheby's London

~$9.0M adjusted

Bord de rivière

Pierre-Auguste Renoir

Riverbank subject connects thematically to Seine leisure/boating, but likely smaller/less ambitious work. Useful to show the lower-end baseline for modest river scenes versus a major 1870s trophy.

$318K

2025, Sotheby's New York

La Leçon d’écriture (The Writing Lesson)

Pierre-Auguste Renoir

Well-provenanced Renoir oil sold in 2025; later date (1905) and domestic subject. Helps frame the current mid-seven-figure range for attractive, fresh Renoirs without the iconic 1870s subject matter.

$2.7M

2025, Christie's Paris

L’enfant et ses jouets — Gabrielle et le fils de l’artiste, Jean

Pierre-Auguste Renoir

Fresh-to-market, late-19th-century family scene; evidences healthy demand around $2m for non-trophy Renoirs. Useful as a lower bound relative to a canonical 1870s leisure subject.

$2.1M

2025, Drouot, Paris

Current Market Trends

Impressionist/Post-Impressionist demand has been selective but resilient, with disciplined bidding and notable strength for museum-caliber, fresh-to-market works. After a slower 2023–2024 at the aggregate level, recent marquee seasons demonstrated renewed appetite for category-defining pictures, supported by third-party guarantees and tight curation. Within this context, Renoir performs best when subject, date, quality, and provenance align—precisely the case for major 1870s compositions. Scarcity of true trophies continues to underpin pricing power, and while Monet leads the segment, prime Renoir works with iconic themes command significant competition, supporting high–eight-figure valuations when offered in optimal market conditions.