How Much Is In the Garden Worth?

Last updated: January 17, 2026

Quick Facts

- Methodology

- comparable analysis

Indicative valuation for Pierre-Auguste Renoir’s In the Garden (1885, State Hermitage Museum) is $25–45 million on an insurance-style, hypothetical basis. The range reflects its large scale, prime-period multi-figure composition, and museum-level significance, benchmarked against recent top Renoir results in the $10–25 million band and the artist’s historic $78.1 million record.

Valuation Analysis

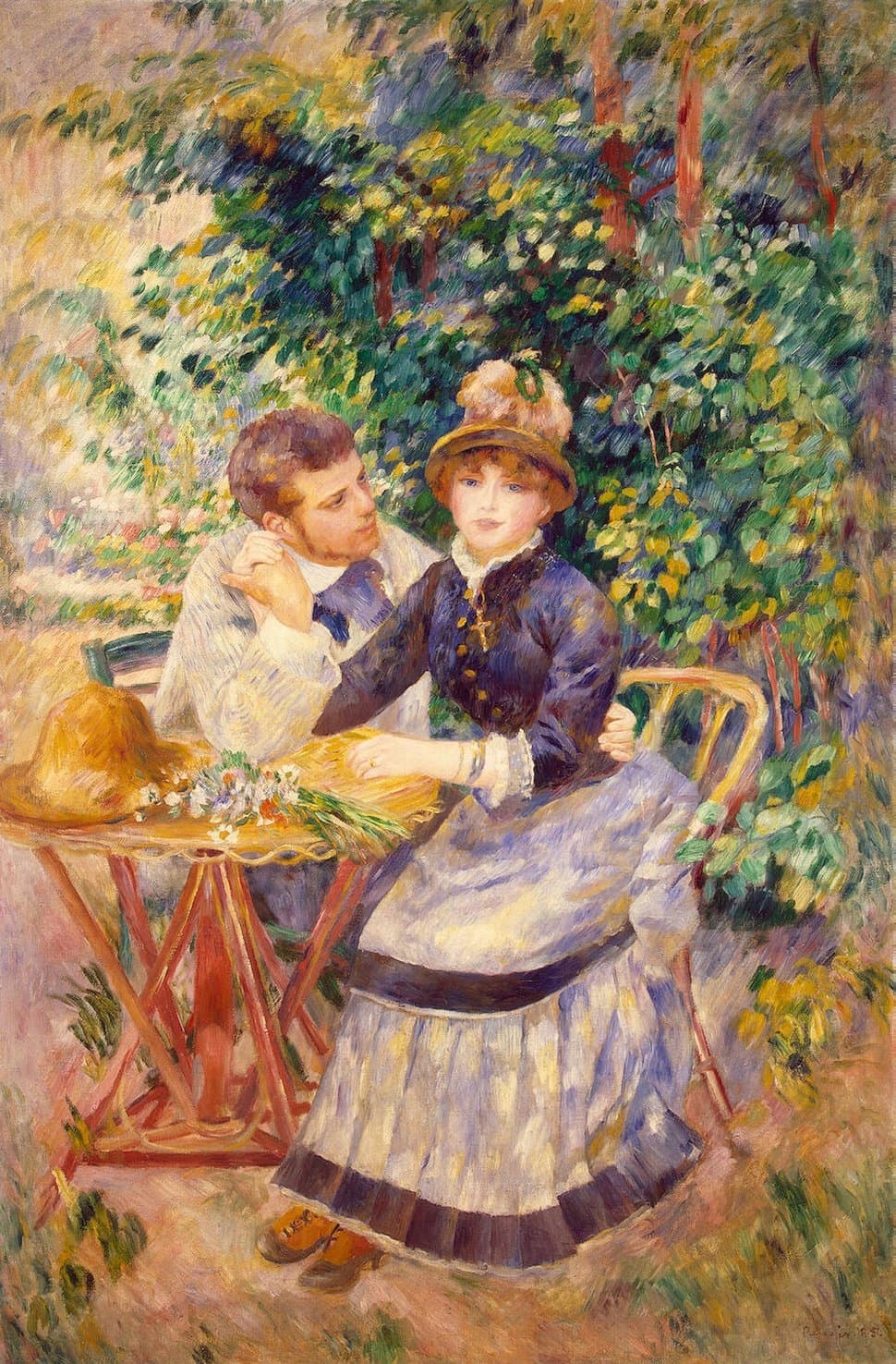

Estimate: $25–45 million (insurance-style, hypothetical). Pierre‑Auguste Renoir’s In the Garden (1885; oil on canvas, 170.5 × 112.5 cm) is a large, prime‑period, multi‑figure composition in the State Hermitage Museum. The Hermitage presents the work as among the artist’s significant canvases, and it hangs in the museum’s dedicated Renoir gallery, underscoring institutional stature and art‑historical weight [1].

Methodology and benchmarks. This valuation is derived by comparable analysis against recent Renoir auction results for high‑quality oils, supplemented by the artist’s long‑standing record. Renoir’s auction record remains Bal du moulin de la Galette at $78.1m (Sotheby’s, 1990) [2]. In the current cycle, a double portrait—Berthe Morisot et sa fille, Julie Manet—realized $24.435m (Christie’s, 2022) [3]; Square de la Trinité made $11.91m (Christie’s, 2023) [4]; the still life Bouquet de lilas achieved about $8.7–$8.9m (Sotheby’s, London, 2024) after competitive bidding [5]; and a Baigneuse (1891) realized $10.41m (Christie’s, 2025) [6].

Positioning of In the Garden. Dated 1885, the painting sits in Renoir’s sought‑after “Ingres period,” following his reassessment of line and classical structure in the early 1880s. The work’s scale (over 67 × 44 in.), ambition (multi‑figure garden setting), and period align with the most commercially resilient categories in the artist’s oeuvre. On qualitative grounds, it should command a premium over smaller, single‑figure portraits and routine late works that typically transact in the mid‑single‑digit to low‑teens millions.

Why $25–45 million. The upper end of recent, non‑record Renoirs peaks around $24–25m for museum‑caliber portraits, with complex compositions from the classic 1870s–mid‑1880s trading around $10–12m when smaller or less pivotal. Given In the Garden’s museum‑designated significance, commanding size, and prime period, a valuation above those mid‑teens comparables is justified, while remaining well below the $78.1m reserved for truly canonical icons. The $25–45m range captures this premium and accommodates upside for exceptional condition, literature, and exhibition history, as well as present market depth for blue‑chip Impressionism [2][3][4][5][6].

Practical note. The work is a Russian state museum holding and not a market candidate; the valuation functions as an insurance‑style or notional fair‑market figure for loan or risk purposes. Provenance through Durand‑Ruel and early 20th‑century German collecting further supports quality and historical interest; institutional stewardship supports conservation standards that bolster value perception, subject to a formal condition report [1].

Key Valuation Factors

Art Historical Significance

High ImpactIn the Garden belongs to Renoir’s 1885 “Ingres period,” when he rebalanced Impressionist color with a renewed emphasis on drawing and classical structure. Works from this phase, particularly ambitious multi‑figure compositions, are central to scholarship and collection priorities. The Hermitage’s presentation of the painting as one of the artist’s significant works, and its inclusion in a dedicated Renoir room, confirm its art‑historical weight within the oeuvre and institutional canon. This significance supports an estimate above the band for routine portraits or later nudes and situates the piece nearer the high end of non‑record Renoir pricing, contingent on condition and complete literature.

Period and Subject Desirability

High ImpactCollector demand concentrates on Renoir’s late‑1870s to mid‑1880s figure compositions, with garden or terrace settings among the most coveted subjects. The 1885 date places the painting in a commercially resilient window, and the garden motif adds narrative and decorative appeal that typically outperforms less dynamic subjects. Recent benchmarks for strong figural works in adjacent years have cleared $10–25 million, demonstrating market appetite for attractive, period‑correct subjects with depth of composition. Against these comparables, a major 1885 garden scene merits a premium positioning in today’s selective but quality‑focused market.

Scale and Composition

High ImpactAt 170.5 × 112.5 cm (67.1 × 44.2 in), the painting’s large format and multi‑figure complexity elevate its impact well above typical day‑sale sizes. Scale correlates positively with price in Renoir’s market, especially when paired with resolved composition and strong state of preservation. Ambitious canvases capable of anchoring an Impressionist wall or museum gallery deliver a scarcity premium—few works of this size and period surface—and provide the visual gravitas that drives top-tier bidding. This factor materially supports the valuation’s upper half, assuming clean condition and robust exhibition and publication history.

Provenance and Institutional Context

Medium ImpactProvenance through Durand‑Ruel and early ownership by Otto Gerstenberg aligns the work with elite collecting and dealer networks that shaped Renoir’s early market. Today, the painting’s long tenure at the State Hermitage Museum strengthens its cultural significance and caretaking standards; however, as a Russian state holding, the work is not practically marketable. The non‑market status means the figure here is an insurance‑style proxy, not a disposal expectation. In valuation terms, the illustrious provenance and institutional setting support quality and authenticity premiums, while the absence of saleability simply frames the estimate’s purpose rather than its magnitude.

Sale History

In the Garden has never been sold at public auction.

Pierre-Auguste Renoir's Market

Pierre‑Auguste Renoir remains a cornerstone of the Impressionist market with deep global demand and stable liquidity across price bands. His all‑time auction record is $78.1 million for Bal du moulin de la Galette (Sotheby’s, 1990), a benchmark reserved for rare icons. In the current cycle, top works have realized $10–25 million, including the $24.435 million double portrait of Berthe Morisot and Julie Manet (Christie’s, 2022), $11.91 million for Square de la Trinité (Christie’s, 2023), and $10.41 million for a Baigneuse (Christie’s, 2025). Demand is strongest for major 1870s–mid‑1880s figural compositions and attractive, well‑provenanced works, while later nudes, routine portraits, and landscapes tend to transact in the low‑ to mid‑single‑digit millions.

Comparable Sales

Berthe Morisot et sa fille, Julie Manet

Pierre-Auguste Renoir

Same artist; major late-19th-century double portrait of intimate sitters; museum-caliber figural composition establishing the upper range for strong Renoir oils.

$24.4M

2022, Christie's New York

~$27.1M adjusted

Square de la Trinité

Pierre-Auguste Renoir

Same artist; late-1870s multi-figure urban composition; evidences demand for complex compositions near Renoir’s classic period.

$11.9M

2023, Christie's New York

~$12.6M adjusted

Baigneuse (1891)

Pierre-Auguste Renoir

Same artist; early-1890s figure painting sold in a recent evening sale; a benchmark for high-quality single-figure Renoirs.

$10.4M

2025, Christie's New York

Jeune fille à la corbeille de fleurs

Pierre-Auguste Renoir

Same artist; c.1890 female figure with floral motif; close in mood and period adjacency; demonstrates market appetite for attractive figural subjects.

$12.9M

2021, Sotheby's New York

~$15.2M adjusted

Bouquet de lilas

Pierre-Auguste Renoir

Same artist; earlier (1878) still life that outperformed estimates; useful as a lower-bound quality benchmark even though not figural.

$8.7M

2024, Sotheby's London

~$9.0M adjusted

Buste de femme, de profil

Pierre-Auguste Renoir

Same artist; 1884 Ingres-period portrait very close in date and style; indicates pricing for smaller, linear works from the same stylistic phase.

$7.2M

2022, Sotheby's London

~$8.0M adjusted

Current Market Trends

Impressionist/Post‑Impressionist auctions softened in 2023–2024 amid fewer trophy consignments, but late‑2025 marquee weeks signaled renewed high‑end confidence. The segment remains selective with a pronounced flight to quality: fresh‑to‑market, best‑of‑type works with recognized provenance and prime‑period subjects still draw competitive bidding, while middling material sells more price‑sensitively. Paris has gained share for Modern consignments, and London/New York remain pivotal for top lots. Within this context, blue‑chip Impressionists like Renoir exhibit durable demand, with complex, large‑scale figure compositions achieving notable premiums over smaller or later works, anchoring the $10–25m band and supporting higher valuations for museum‑caliber examples.

Sources

- State Hermitage Museum — Room 408 (Renoir)

- Guinness World Records — Most expensive painting by Renoir sold at auction

- Christie’s — Berthe Morisot et sa fille, Julie Manet (Price realized)

- Artnet News — Christie’s 20th Century sale results (includes Square de la Trinité)

- Financial Times — Sotheby’s London June 2024 (Bouquet de lilas result)

- Christie’s — November 2025 Evening Sales roundup (includes Renoir Baigneuse)